Help Give Yourself the Security and Financial Freedom You Deserve to Enjoy Your Retirement!

With a Custom Financial Strategy Built Around Your Goals and Unique Situation.

Valais is a new way to grow your wealth and work towards your financial goals!

Here’s how some financial advisors work…

A senior advisor talks to you on the phone or meets with you in person and goes over all your finances, your 401k, retirement plans or pensions, cash in the bank, tax strategies, estate planning, you know… the works.

Then, once they have your money, they invest it all in a package of the same “diversified portfolio” as everyone else (depending on your “risk tolerance”) and they schedule a call with you in 6 months.

In 6 months, you talk to them on the phone and they tell you how your “portfolio’s” performing.But here’s the thing you may not know… As long as it’s performing average or better, they don’t touch it.

That’s right, they keep your money in the same package month after month, year after year and collect the fees.

So, you’re basically paying them to leave your money where it’s at and talk to you once or twice a year. Sounds familiar, doesn’t it?

At Valais Wealth Management, we know life events happen more than once a year and there’s no “one size fits all” cookie cutter approach to wealth management.

You may have kids going to college, or a wedding, or a family vacation, or a new property you’re trying to buy, right?

That’s why at Valais, we call you every 3 months to see how you’re doing, show you how your wealth has grown, and see if you have any new goals or life events that warrant a change to your strategy.

It’s a completely new way to manage your wealth, high touch custom planning from a friend who knows you!

Say goodbye to paying fees to leave your money alone and talk to you once a year (if you’re lucky) and hello to effortlessly working towards your financial goals with a custom tailored plan for you based on your unique situation!

Ready to Effortlessly Work Towards Your Financial Goals and Have the Freedom and Security You Deserve?

Making Just One of These Mistakes Can Cost You Hundreds of Thousands of Dollars!

Haven’t you ever thought there may be a better way to grow your wealth faster and maybe you’re not currently doing everything you can to maximize your retirement planning?

Here’s the deal, most wealth management advisors give you the same cookie cutter approach they’re using for everyone else, and this means you could be making some BIG mistakes that are holding you back from reaching your financial goals.

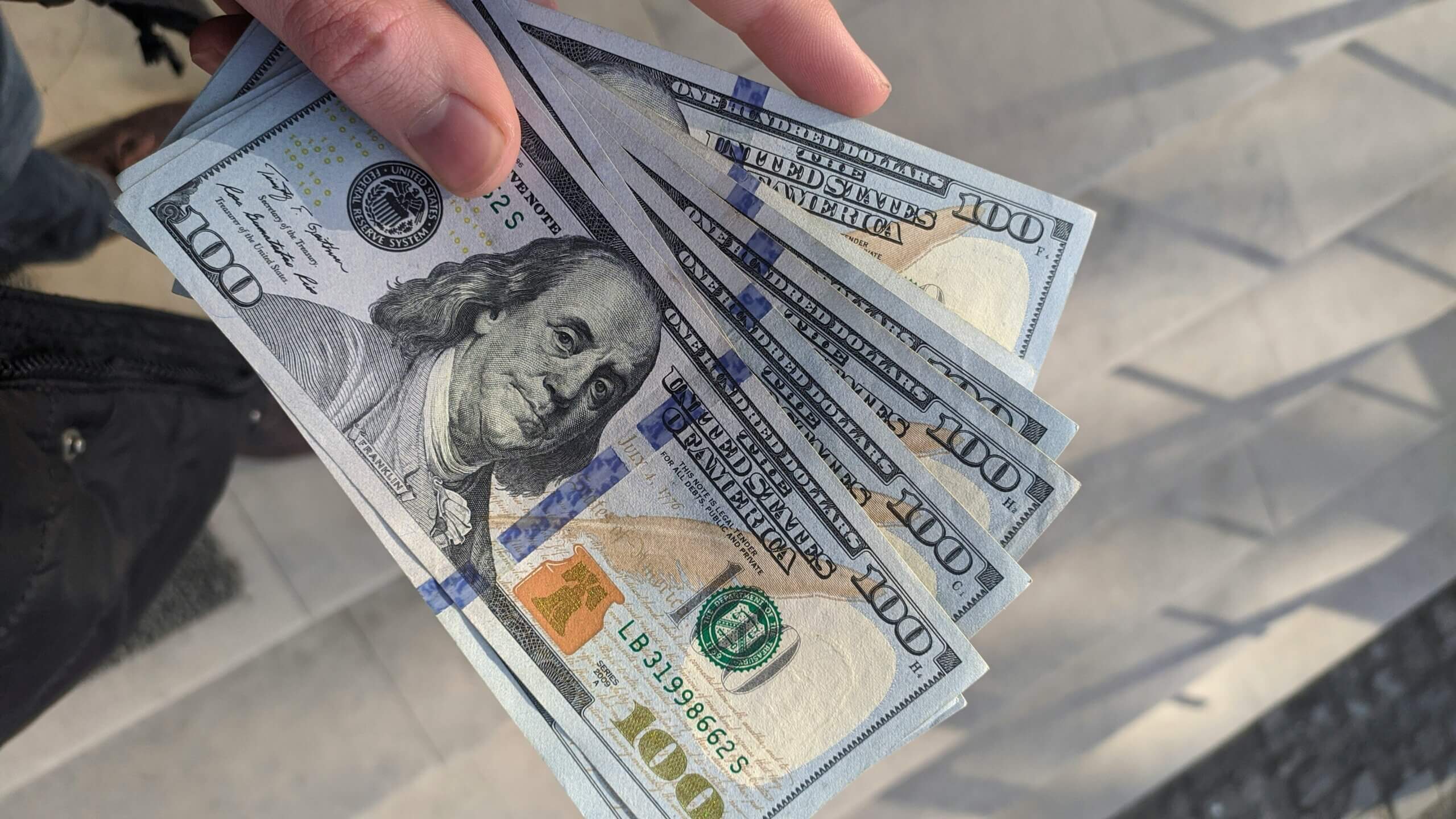

Even worse, these mistakes compound over time the longer you make them and can be the difference between having the freedom to do whatever you want, whenever you want, taking the grandkids on vacation and making happy memories, knowing you could always have bushels of cash leftover every month…

Or living a life constrained by your finances, constantly worried and penny pinching, struggling to make ends meet.

But don’t worry, here’s the good news! We’ll list some of these mistakes you’re likely making that are holding you back right now and tell you how you can fix them!

*Remember, no guarantees can be offered that your investment goals and objectives will be attained. Investing always involves inherent risk, including the loss of principal.

01

Neglecting Your Old 401k Plans

Many times, you have a 401k from a previous employer that you never touch or look at, and often it can be getting suboptimal returns to put it lightly.It’s absolutely crucial to consolidate your accounts to strive towards optimizing your returns and keep the same winning strategy helping to grow all your buckets of wealth!

02

Default Investment Options

As you’re already aware, your employer doesn’t actively manage your investments. You pay in, they may match a percentage of it, but it’s likely being allocated to a one size fits all investment option like a Target-Date Fund or Balanced Fund. These can be boring investments with a mixture of stocks and bonds that can get more conservative over time.

What does that mean? It means they’re often designed to keep you from losing money, not necessarily to make you money. That’s great if you already have $500k+ and a very low risk tolerance but you may be comfortable taking on a little more risk for the opportunity of a BIGGER reward.

You need a strategy that fits your long-term goals and your risk tolerance, and you may not get them from default options, which is why you need a personalized investment strategy!

03

Overlooking Tax Diversification

There are many tax strategies you could be using to maximize your earnings for retirement, and it’s important that you time them correctly to avoid potentially paying tens of thousands of dollars in unnecessary taxes later.

For example, imagine you’re 30 and paying $6000 every year into a traditional IRA.

By age 60 you’ve contributed $180,000 and assuming a 7% annual return, your account grows to approximately $611,730.

Congratulations!

When you go to withdraw, you pay 25% in taxes, or $152,933.

That’s right, $150k of your hard-earned money goes right to Uncle Sam.

Now, imagine the same scenario, but this time, you met with Valais Wealth Management, and we helped you transfer your traditional IRA into a Roth IRA. Same $6000 a year contribution, $180,000 at 60, 7% annual growth and $611,730 in your account.

But this time, you already paid 25% taxes on your $6000 contributions every year, or $1500 a year.

Over 30 years, this means you pay $45,000 in taxes instead of $152,933 in taxes, saving you $107,933!

Wouldn’t you rather have that $100k in retirement instead of giving it to Uncle Sam?

And if just one tax strategy from Valais Wealth Management can save you over $100k, isn’t it worth a 30 minute phone call with an experienced advisor to see what other strategies can potentially add hundreds of thousands of dollars to your retirement?

Not taking full advantage of company benefits like HAS, ESPP, and 401k matches means you’re missing out on free money, not having an estate plan can result in high taxes and complications for your heirs, and the wrong retirement distribution plan risks you losing tens of thousands of dollars, especially during market downturns.

And we haven’t even covered the costly mistakes you can make after retirement

Ignoring Required Minimum Distributions (RMDs) can push you into a higher tax bracket and cost you thousands of unnecessary taxes, misunderstanding the tax implications on social security can lead to unexpected tax on your retirement income, and underestimating retirement costs can lead to financial strain and even mean you have to return to work!

If we covered all the mistakes you’re likely making that can cost you hundreds of thousands of dollars of your hard earned money, this article would be over 20 pages long.

Avoid Costly Mistakes With a FREE 30 Minute Strategy Session with Valais Wealth Mangement!

So, Why Haven’t I Heard of Valais Wealth Management Before?

That’s a great question!

You’re probably wondering… why should I trust some random boutique firm I’ve never heard of, right?

Well, let me introduce myself, I’m Calvin Thomas, and I have over 20 years of experience in Wealth Management.

My partners and I previously founded Abbey Wealth in Europe where over the past 15 years we grew to over 3000 clients in 50 countries and a BILLION dollars in managed assets.

And we had a 4.7-star rating on Trust Pilot with over 800 reviews. (You can go see for yourself)

You don’t hit those numbers and satisfaction level if you don’t know what you’re doing, right?

My co-founder and I sold Abbey wealth a couple years ago and now we’ve moved from Europe to the good ol’ USA, right here in sunny Miami Florida to do it again!

And that’s great news for you!

“Why?”, I hear you ask in your American accent…

Because some firms may pass you off to an entry level advisor once they have your money.

Which could mean you’re possibly gambling your future retirement on the training of a new advisor.

But Valais Wealth Management is an opportunity to get the professional advice you need from an industry veteran like myself.

It’s a chance to have your money, actively managed by my partners and I using the exact same strategies we use for ourselves!

My partners and I sold Abbey a couple years ago and trust me, we have enough to retire, I don’t do this for the money, I do this because I enjoy it, it’s my passion in life, I LOVE helping people like you discover your wealth potential and live your dream life in retirement!

Can you say that for your current advisor?

If you’re gonna trust anyone to advise you on growing your wealth and investing wisely, the first place you should look is THEIR finances.

You wouldn’t trust a builder to build you a home if he lived in a dilapidated, run-down house that was falling apart would you?

Yet, that’s what most people do!

They put their financial future in the hands of someone with less than ideal personal finances.

This is like getting marriage counseling from a person with 3 divorces, it just doesn’t make sense, right?

If there’s one piece of advice you take from this whole thing, it’s to do your due diligence when picking the right advisor.Choosing your financial advisor is like picking your spouse, get it right and you live a life of happy prosperity, get it wrong and you can have endless heartache and regret.

And even if you’re happy with your current advisor, it never hurts to get a new set of eyes on your unique situation who may have a different strategy or way of thinking to look at your portfolio and give you some free advice!

You have nothing to lose but 30 minutes of your time, and isn’t it worth 30 minutes when one single tip can potentially save you hundreds of thousands of dollars?

Get a Senior Advisor with Many Years of Experience to Give you Their Professional Advice!

Don’t Settle for a One Size Fits All Financial Plan, Get a Custom Tailored Plan Just For You!

At Valais, we have a new and different approach to wealth management.

Your life and goals are constantly changing, and you deserve to talk to your advisor more than once a year.

That’s why we truly take the time to get to know you, your goals, your unique situation and circumstances, so we can offer you the best strategy to get exactly what you want.

Do you need to access your funds early?

We can guide you through legal loopholes to access your money early, often without penalties, should the need arise.

Whether you’re trying to fund a wedding, buy a vacation home, or planning a family reunion, we can help you manage these events without financial strain.

Do you wanna sail off on your next cruise, make memories with the Grandkids at Disneyworld, hit the golf course with your buddies?

We’ll help you build the map and blueprint to financial freedom in retirement, so you can enjoy life without worrying about making ends meet.

Whether you’re early on in your investing journey, about to retire, or well into your golden years, we’ll take a look at your current retirement plan and find areas for improvement to make sure it’s aligned with your long-term goals.

Don’t you want the peace and security to know that if anything happens to you, your legacy will be passed down and preserved according to your exact wishes, helping to ensure your family isn’t left with financial burden, unnecessary taxes, strife and uncertainty?

We can advise you on the best strategy for estate planning so you can sleep easy at night knowing your family’s taken care of

Need to pay for the kids or grandkids college?

Beyond the standard 529 plans, we can show you strategies to defer taxes, save more effectively for college, or access funds now, often reducing or even negating penalties.

Unlike passive strategies you get with some wealth management advisors, at Valais Wealth Management, we actively manage portfolios, making very well informed decisions based on your exact wishes and preferences, whether you want to invest in renewable energy, artificial intelligence, or whole sectors like “technology”, we got you covered!

And, we have extremely transparent fees and communication.

We’ve heard horror stories of advisors of 10 years moving positions and your account being handed to someone you don’t even know without anyone telling you.

That’ll never happen at Valais, we’ll call you every 3 months to see how you’re doing, check on your goals, review your wealth growth, and make sure you and your family are doing amazingly well!

And should your financial advisor ever change, we’ll notify you immediately, schedule a call for you to meet them, make sure you’re happy and satisfied, and guarantee a fresh and new perspective on your portfolio.

When you choose Valais Wealth Management, you get a comprehensive approach custom tailored to you, like a well-fitting suit or blouse.

You guarantee you avoid common mistakes and pitfalls that cost you thousands of dollars of your hard-earned money and get the very best financial advice to optimize your retirement strategy.

We help you strive towards freedom and financial security in your retirement to enjoy the lifestyle you desire, and the confidence to know you can spend what you want when you want and always have the money to effortlessly afford it.

And that’s what you really want, isn’t it?

At Valais, we’ll guide you on how to make that dream a reality!

Experience the Valais Difference for Yourself When You Schedule Your FREE 30 Minute Strategy Session Right Now!

A Letter From the Desk of Calvin Thomas, A Tale of Two Tales.

Dear Reader,

It was a bright spring morning many years ago, and two men, Jack and Tom, walked across the stage to receive their college diplomas.

They were very much alike, these two good friends. Both had studied hard, both were a little “eccentric”, and both had BIG dreams for the future.

A year later, Jack and Tom found themselves working at the same technology firm, enjoying their roles and earning well.

Life, as it often does, moved swiftly, filled with family, work, and the everyday hustle.

Twenty-five years later, at their college reunion, Jack and Tom’s paths crossed again.

Much was the same between them.

Both had loving families, three children each, and continued to work at the same company.

But yet, there was something drastically different in their demeanors and behaviors.

Jack was relaxed and easy-going, with a carefree airiness that drew others in.

He spoke excitedly about his recent trip to Switzerland with his family, sending his oldest daughter to Yale, his plans for early retirement and his new ventures into philanthropy.

Meanwhile, Tom seemed weighed down by concerns.

He talked about delaying his retirement, worried about his finances and how he wished he had the time and resources to travel and spend time with his family.

The big difference wasn’t just in their demeanor, it was in how they made decisions.

Jack made decisions based on his desires, while Tom made decisions based on whether he could afford it.

So, what made the difference?

You may wonder, as I did, what led to this fork in their paths arriving at drastically different outcomes.

Was it just hard work, or luck?

No.

The difference was in the decisions they made around managing their wealth.

Jack had received advice from an experienced financial advisor who designed a custom-tailored plan, just for Jack.

Upon starting his career, Jack learned the true power of early and strategic investing, the benefits of Roth IRAs, and the importance of aggressively investing early and diversifying as your wealth grows.

Jack used Roth accounts for tax-free growth and strategically planned his withdrawals to minimize taxes.

He always maximized his employer’s 401(k) match, invested in HSA accounts, and took advantage of every financial opportunity his company offered.

He also set up an estate plan, ensuring his family’s future was secure and his legacy would continue.

To this day, Jack maintains regular contact with his advisors every 3 months, constantly adjusting his strategies as markets changed and his personal goals evolved.

But Tom, unfortunately, didn’t seek specialized financial advice.

He put his money into the default 401(k) options, didn’t fully utilize his company’s match, and missed out on tax-savings opportunities.

He delayed estate planning and was often reactive to market changes, leading to missed opportunities and higher tax bills.

And as retirement neared, Tom found his savings insufficient to support his dream retirement lifestyle.

The Power of Knowledge and Strategy

Jack’s story wasn’t just about building wealth; it was about using knowledge and strategy to build a life of freedom and choice.

Tom’s story, while filled with hard work, lacked the strategic foresight that Jack’s partnership with his advisor offered.

When you want to achieve something, you should find someone who’s done what you want to accomplish successfully and copy them.

We help people like you work towards their retirement goals successfully and live their dream lifestyle, and achieving this goal isn’t just about hard work or intelligence.

It’s also about having the right knowledge and applying it effectively.

Your Financial Future

You might not be at the start of your career like Jack and Tom were, but whether you’re early in your savings journey, about to retire, or well into your golden years, it’s never too late to make a change.

Whether you’re looking to secure a comfortable retirement, plan for your family’s future, or simply optimize your current wealth building strategy, Valais Wealth Management can guide you.

Click the button and book a free strategy session right now and let’s discuss how we can tailor a financial plan that fits your unique needs and goals.

Learn about our tax optimization strategies, investment advice, and how to make the most of your retirement savings.

Plan for your future with confidence, knowing that our experienced team is here to guide you every step of the way.

Your story doesn’t have to be like Tom’s.

With Valais Wealth Management, you could write a future like Jack’s – filled with freedom, security, and the joy of living life on your terms.

Sincerely,

Calvin Thomas

Senior Wealth Advisor, Co-Founder Valais Wealth Management

P.S.: Remember, in wealth management as in life, the right knowledge, applied at the right time, makes all the difference. Let’s start your journey today.